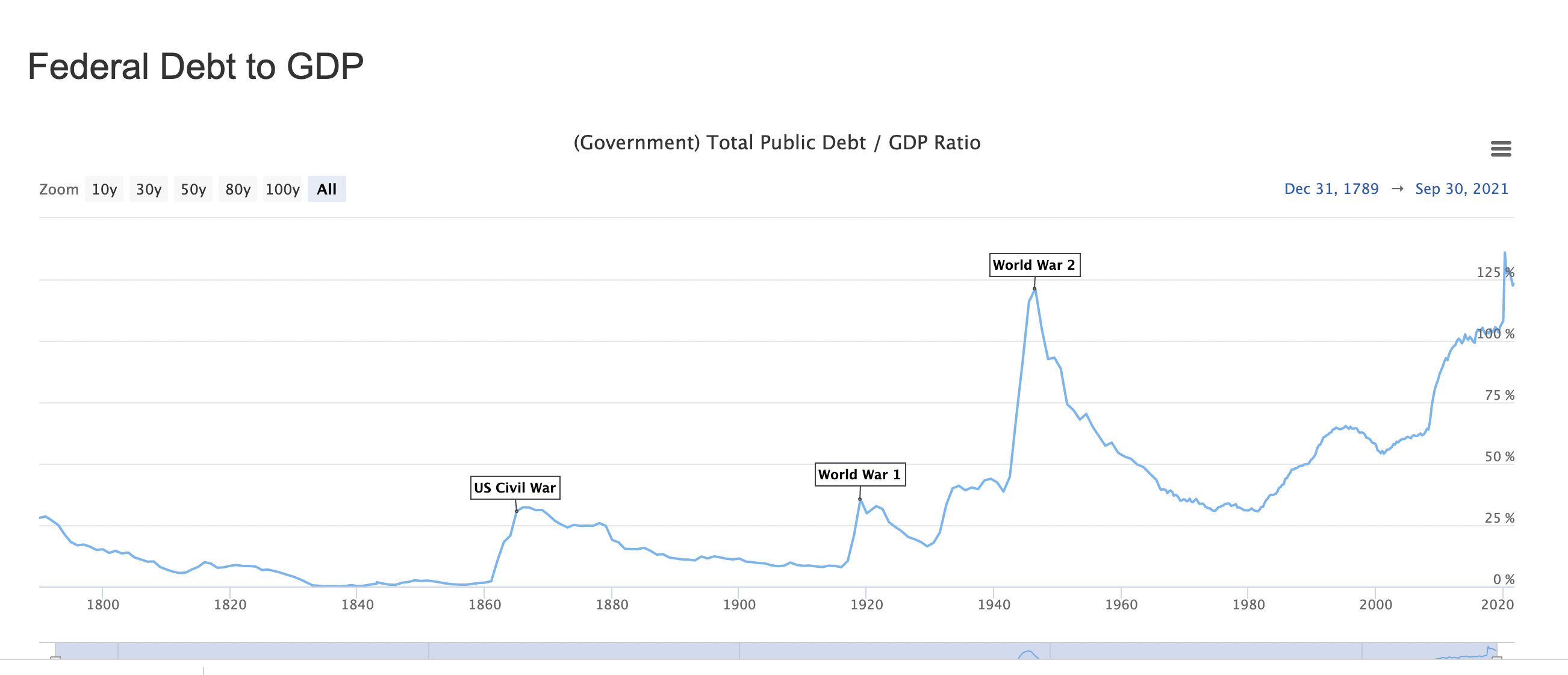

The Public Debt or Federal Debt to GDP ratio was about 1 or 2% in 1860. This is an indication of how small a percentage the government sector was back in 1860. The Debt to GDP ratio went up to about 30% after the Civil War in 1865. Today the Federal Debt to GDP ratio is around 127%. Around 1913, when the Federal Reserve was established, the private sector was about 92% of the economy. (Source: Longtermtrends.net)

🔴 Article: Fraud Risk Management: 2018-2022 Data Show Federal Government Loses an Estimated $233 Billion to $521 Billion Annually to Fraud, Based on Various Risk Environments – GAO (U.S. Government Accountability Office)

POPULAR ECONOMICS WEBSITES

BEA – U.S. Bureau of Economic Analysis

BIS – Bank for International Settlements

BLS – U.S. Bureau of Labor Statistics

FRED – Federal Reserve Economic Data (St.Louis Fed)

GDPNow – preliminary calculations for the GDP (Federal Reserve Bank of Atlanta)

IMF – International Monetary Fund

ShadowStats – see the real rate of inflation:

TreasuryDirect.gov – buy treasury bills, bonds, and notes yourself

Webull Desktop & Mobile Phone App – buy & sell stocks, ETFs, options, forex, etc., etc.

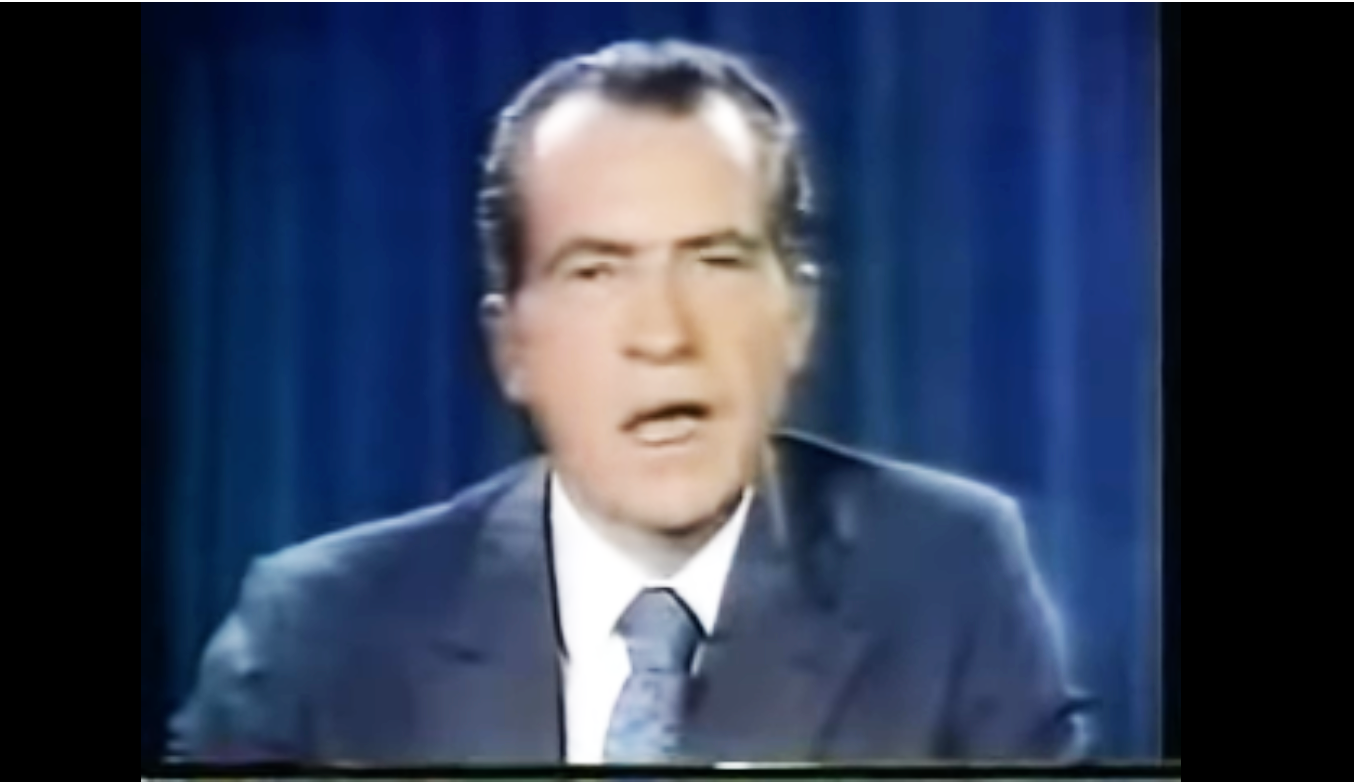

WTF Happened in 1971.com – President Nixon took us completely off the gold standard?

XE.com Currency Exchange Rates – showing the US Dollar to Japanese Yen rate

Yale Law School – 75 Sources of Economic Data, Statistics, Reports, and Commentary

FRED Economic Data – Housing Data – Federal Reserve Bank of St. Louis

Redfin's Housing Data Center – inventory, median sales price, sales forecasts, etc.

Reventure.app – much data on housing market (requires setting up a free account)

Zillow Research – Housing Market Report

Historical Gold Price Chart (10 Year to Present) – (above)

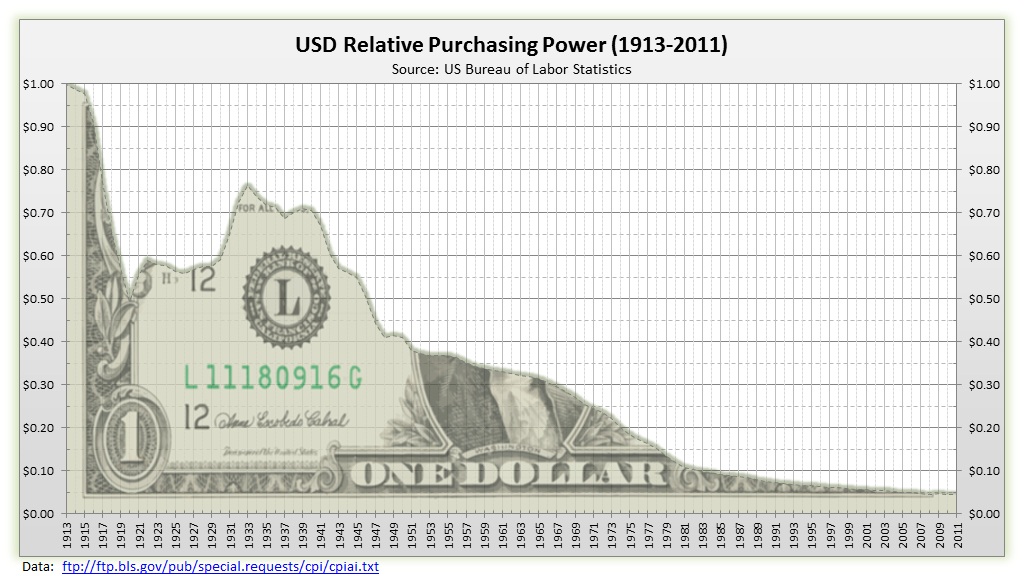

The U.S. dollar has lost about 97% of its value (see above) since the Federal Reserve, our central bank, was created in 1913, despite the Federal Reserve's mandate from Congress for "price stability."

"Free to Choose" Video Series – with Milton Friedman (1980) – on YouTube

🔴 Article: 21 Quotes About Central Banking That Show Why The Federal Reserve Must Be Shut Down – from TheEconomicCollapseBlog.com

Article: The Hidden Cost of Progressivism – for taxpayers earning approximately $50,000 per year, it's about an additional $28,100 per year in hidden taxes

Article: Inflation in the Roman Empire in the 3rd Century AD – Culture Critic (X)

Article: The Weimar Inflation Revisited – central banks are not such a good idea (revisited)

🔴 = Newest videos and articles

The Federal Reserve

The Communist Manifesto (page 70).

It’s insane to think that a group of 19 people or so can determine the correct interest rate and the amount of currency to “print” for a $30.6 Trillion economy.

Articles & Videos on the Federal Reserve

🔴 Video: Central Banks Driving the World into Crisis with G. Edward Griffin – The brilliant G. Edward Griffin (author of "The Creature From Jekyll Island"), the one person on earth who understands the Federal Reserve and central banks better than anyone – Interviewed by Anthony Fatseas, WTFinance

🔴 Video: How Central Banks Plan to Control You | Catherine Fitts – "Central Bank Digital Currencies: Your home, your car, your office becomes a Digital Concentration Camp"

Video: Why The US Must Consider Returning To The Gold Standard – Steve Forbes, CEO of Forbes Magazine

Article: Time To End the Fed and Its Mismanagement of Our Economy – The Heritage Foundation

Video: Interview with Thomas Sowell, economist, by Peter Robinson (2010): The Federal Reserve is a "Cancer"

🔴 = Newest videos and articles

Why the Federal Reserve and central banks are so dangerous:

JP Morgan and Senator Nelson Aldrich (Rhode Island)

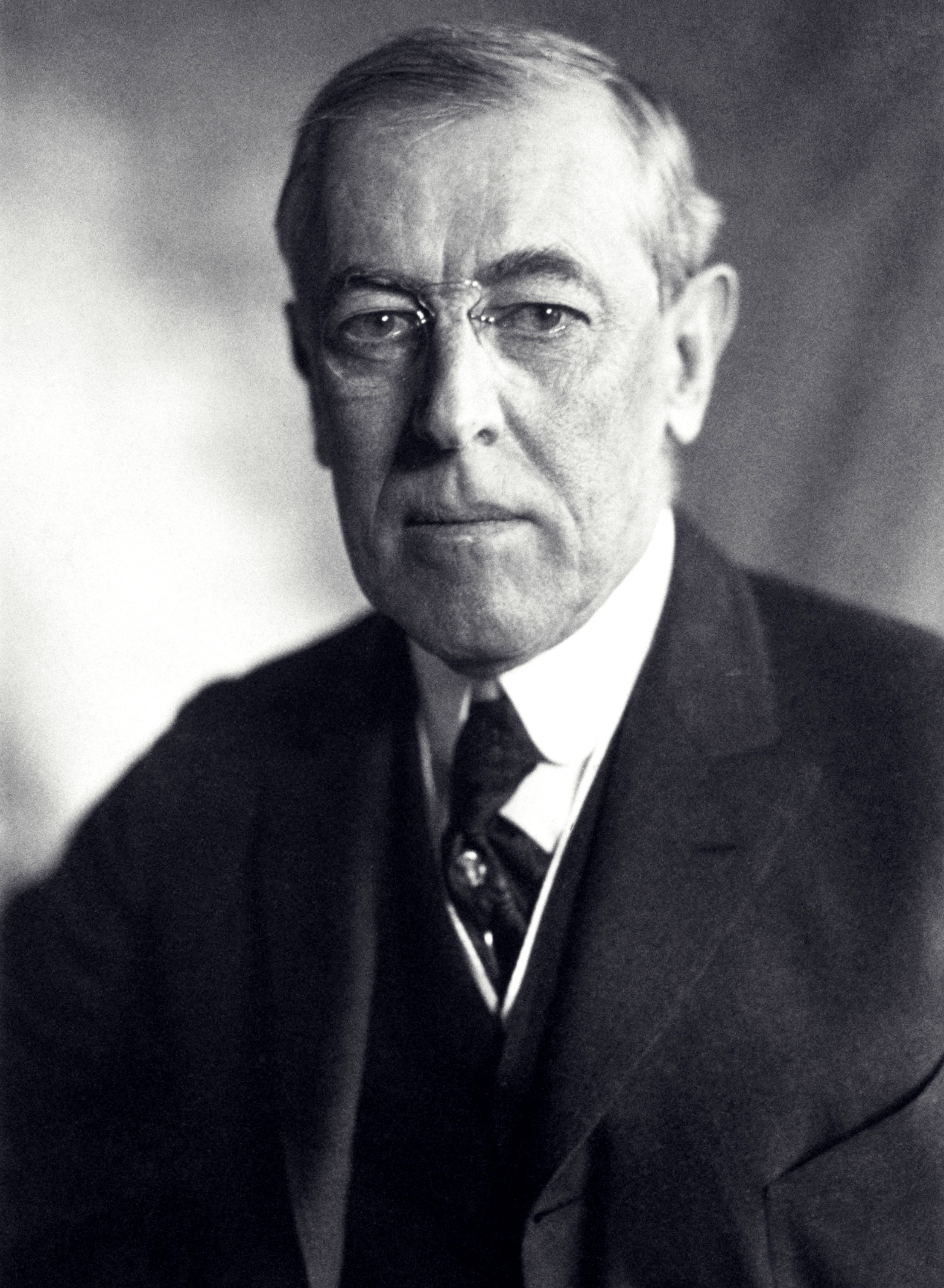

When President Woodrow Wilson created the Federal Reserve bank in 1913, he didn’t realize the whirlwind he had unleashed on the world. Only on his deathbed did Wilson express any regrets in creating our central bank.

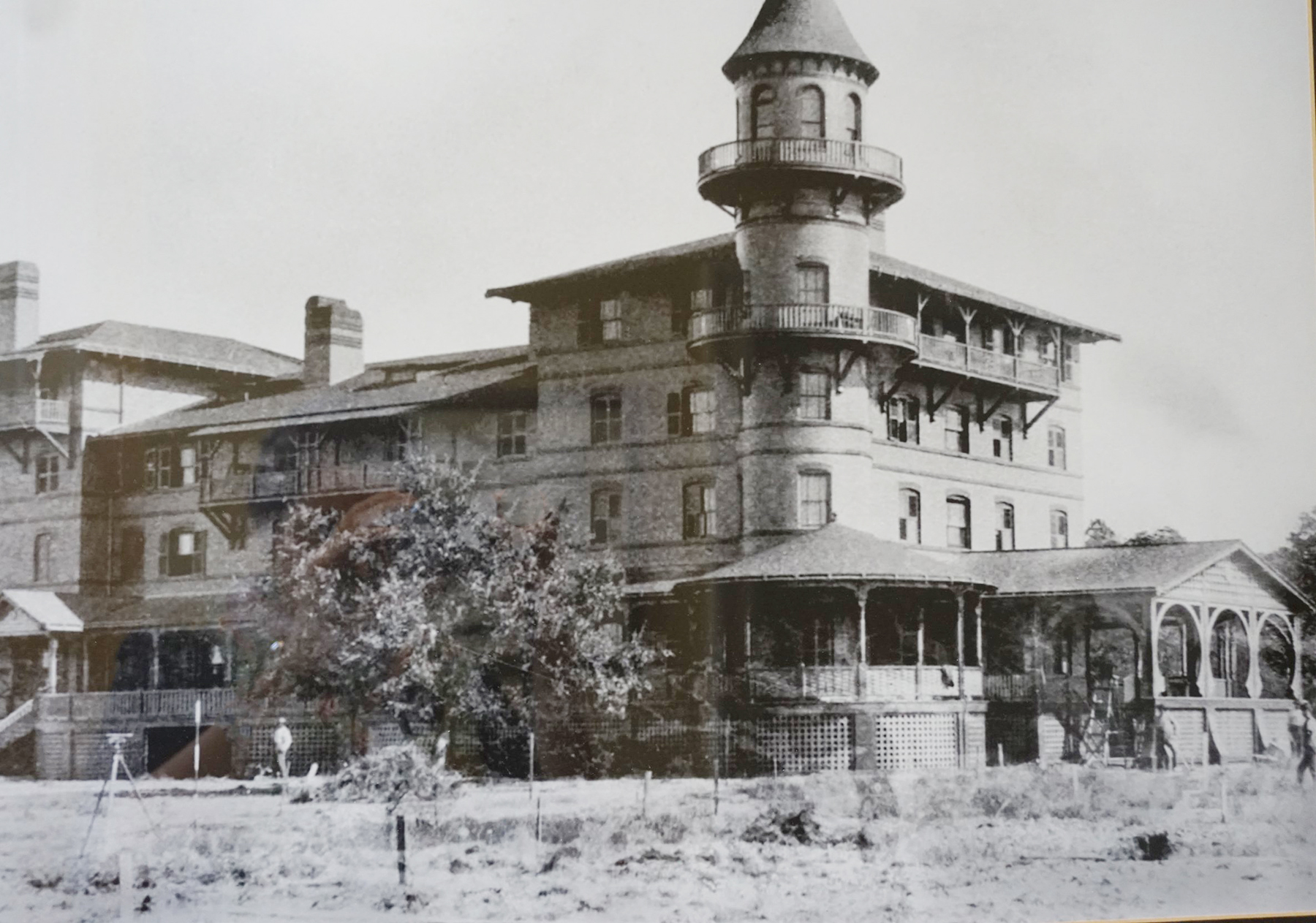

The Federal Reserve Act was created in secrecy by a cabal of bankers and politicians. They used fake names to conceal their identities to board a train from the New York City area to a resort island off the coast of Georgia called Jekyll Island to formulate their plans to create the Federal Reserve. (See G. Edward Griffin’s book, The Creature from Jekyll Island, for more information.)

Jekyll Island Resort, Georgia, USA

Jekyll Island Resort, Georgia, USAThe Federal Reserve Act initially didn’t pass in the Congress. The bankers and politicians realized that the public and their representatives in Congress would naturally be suspicious of a piece of legislation that was crafted by a cartel of New York bankers and was clearly unconstitutional. So, the bankers and politicians who were for the Act decided to fake opposition to the Act.

The Act did pass on its second try and was signed into law by President Woodrow Wilson in 1913.

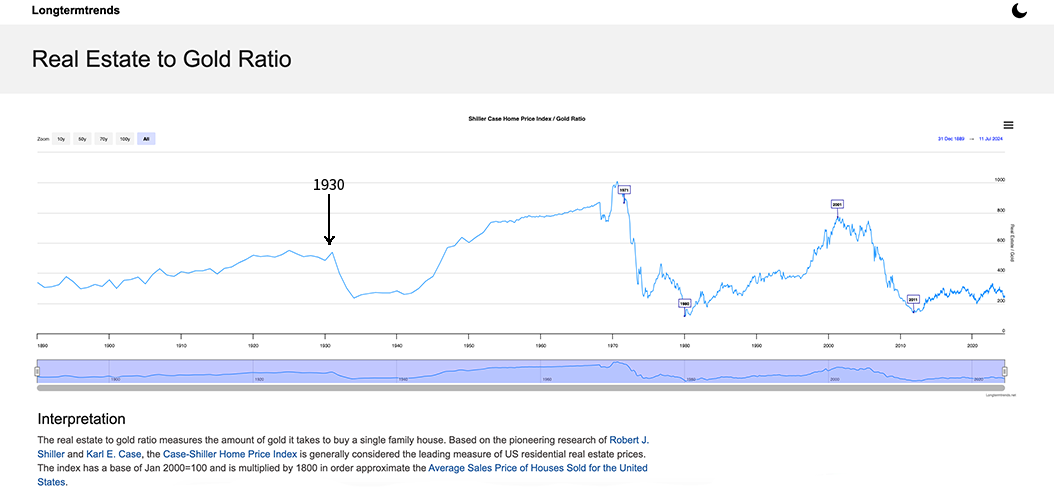

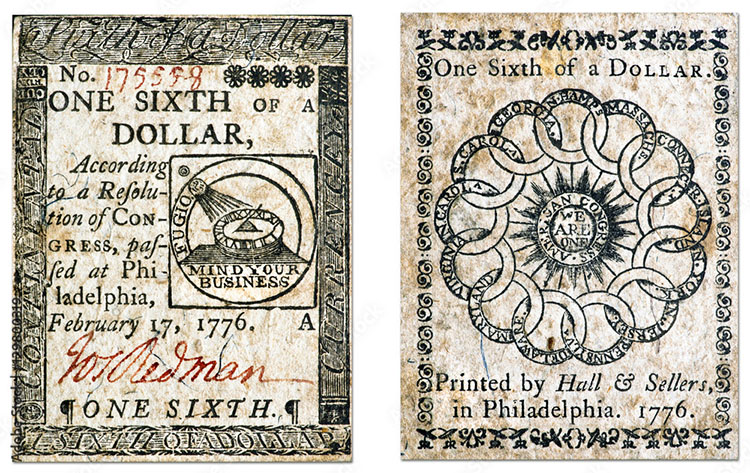

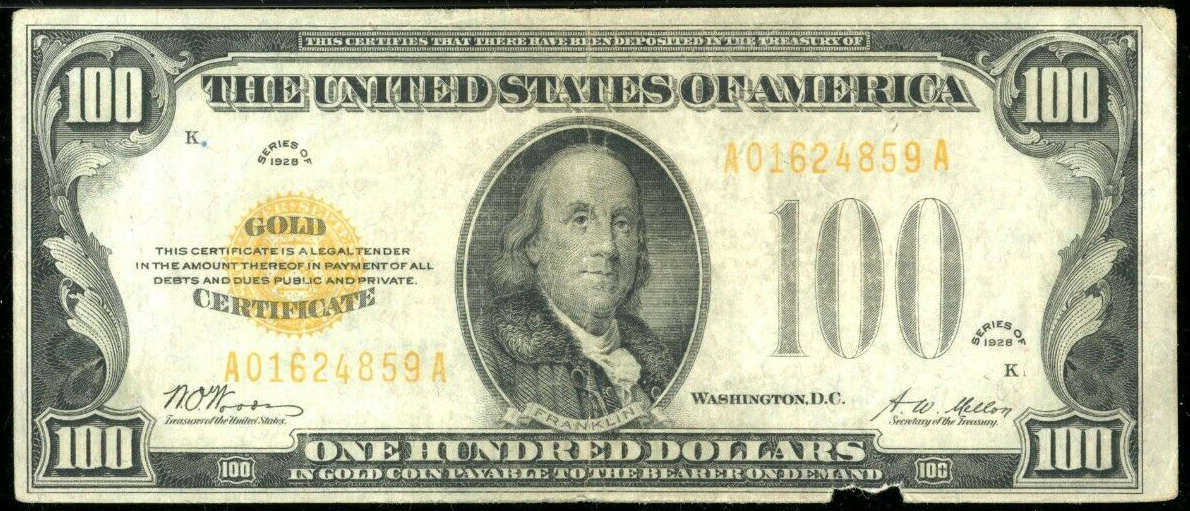

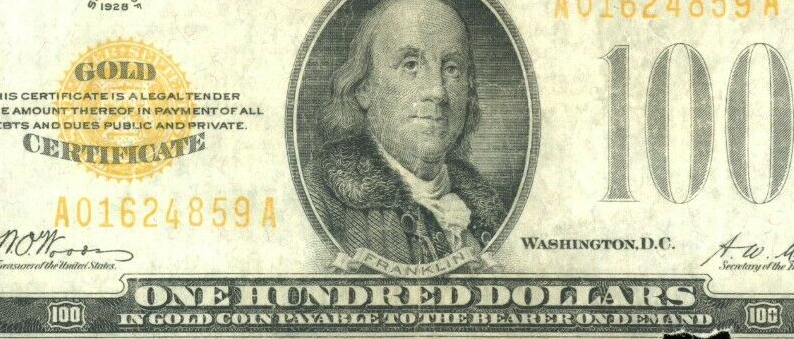

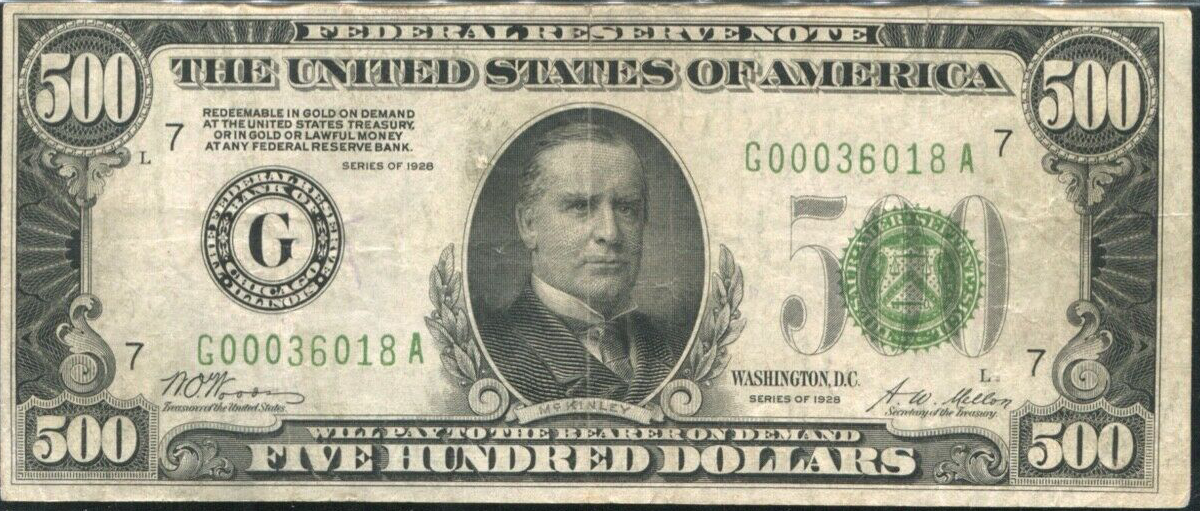

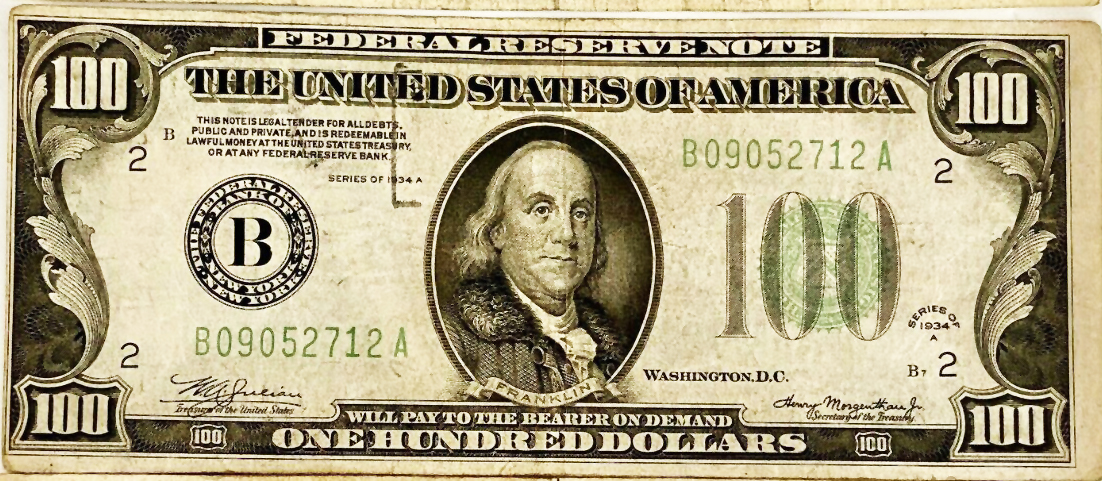

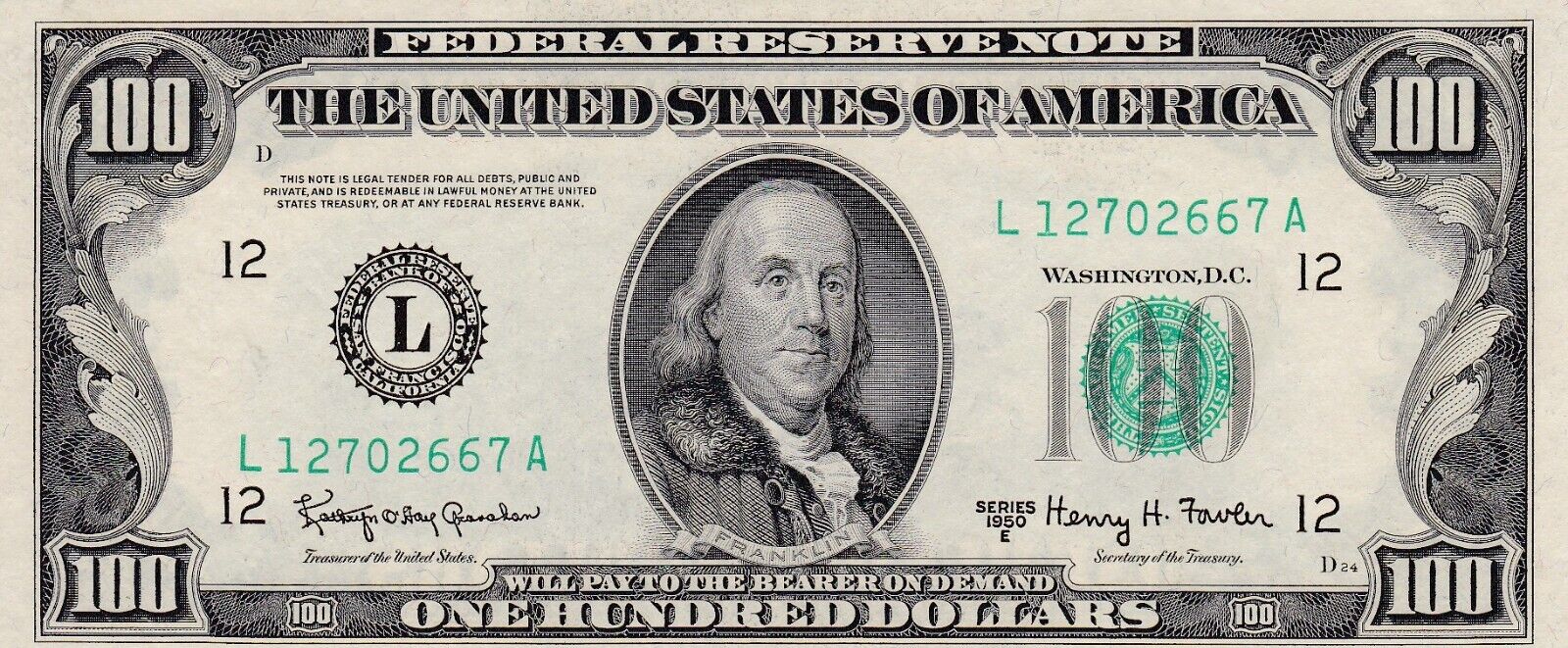

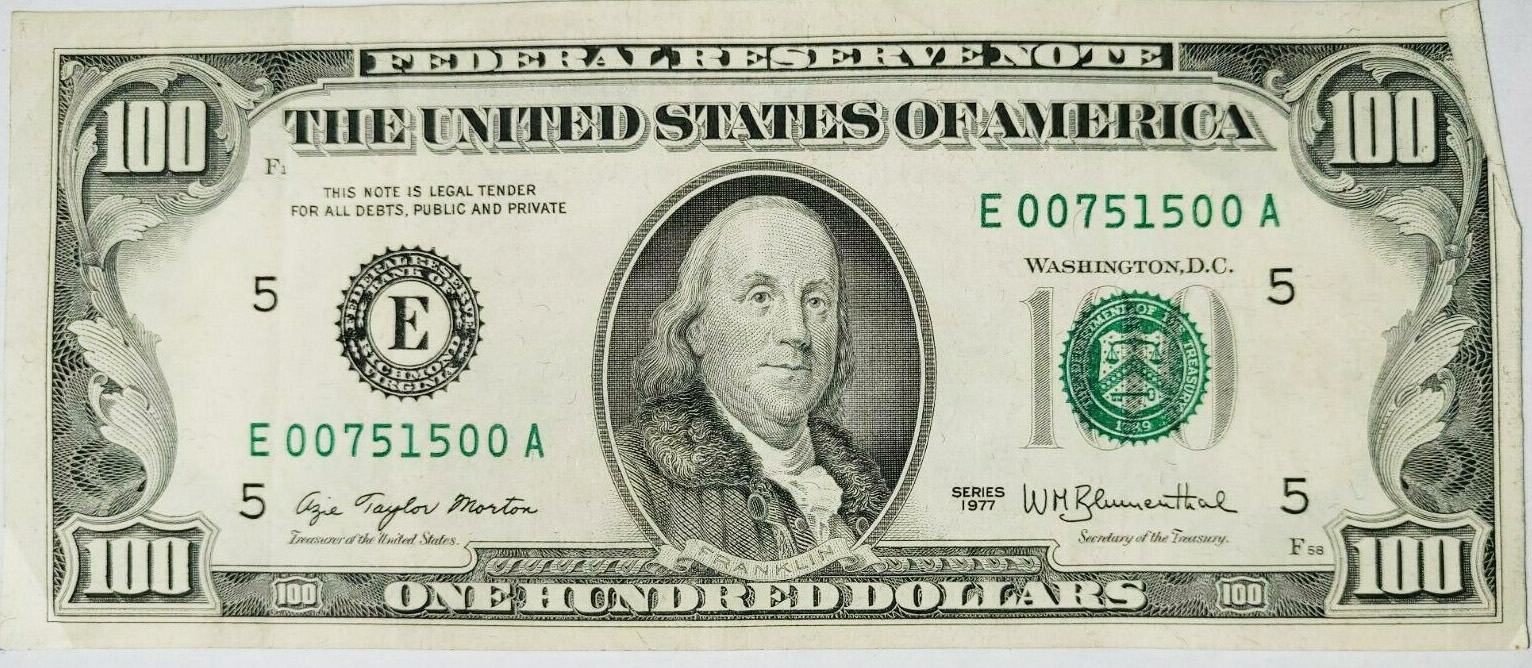

Initially, the Federal Reserve’s harmful effects weren’t too apparent because they still had a very limited charter and upheld the classical gold standard. In other words, they issued currency that was explicitly backed by gold which were essentially gold warehouse receipts. They printed this fact on the bills themselves. (See below.) The problems started when the tie to gold was weakened and then was eventually severed completely in 1971 when President Nixon closed the gold window (Good news: Nixon said it's only temporary!).

Initially, the mandate given to the Federal Reserve (the "Fed") by the Congress didn’t allow the Fed to purchase government bonds (i.e.,Treasury bills, bonds and notes, which is also known as "monetizing the debt"), but this prohibition soon fell away as the country entered World War I and the government needed currency to finance the war.

The Second World War, on the other hand, was largely financed by taxes and by issuing War Bonds, which the population voluntarily purchased to help the war effort. The population had large savings at that time, which naturally occurs under a modified gold standard as the standard of living improves over time, to lend the government billions of dollars to fight the fascists in Europe and Asia in the Second World War. (It is called a "modified" gold standard because FDR banned private ownership of gold in 1933 but foreign banks and governments could still get gold from the U.S. federal government and U.S. banks through the "gold window.") Fort Knox, Kentucky

Fort Knox, KentuckyIn the Great Depression during the 1930’s, Franklin Delano Roosevelt abandoned the classical gold standard when he issued Executive Order #6102 that banned private ownership of gold. The population was required to turn in gold coins and bars to the government in exchange for $20 cash per ounce of gold. (The gold bullion depository at Fort Knox in Kentucky was built during this time to house all of the gold confiscated from citizens.) FDR then raised the price of gold arbitrarily to $35.00 per ounce. This inflated the U.S. dollar by 75%, which FDR hoped would counter the effects of the deflation that was devastating the economy during the Great Depression. Because of the many ineffective and harmful New Deal programs that FDR instituted, many of which were declared unconstitutional by the Supreme Court, the economy failed to recover, and a garden-variety recession soon turned into the Great Depression. (See the book, “The Forgotten Depression: 1921: The Crash That Cured Itself” by Jim Grant, for more information about a recession in 1921 that was as bad or worse than the recession that started the Great Depression, but cured itself when the government did nothing except reduce spending.)

The Federal Reserve is called the Federal Reserve for a reason. Back in 1913 when the Federal Reserve was created, the proponents of the Federal Reserve knew the public wouldn’t accept a central bank because the public knew it was unconstitutional. The public was arguably better educated and much more aware of the importance of the U.S. Constitution back then. (See this exam for 8th graders in rural Kentucky in 1912.) That’s why the Federal Reserve Bank is not called “The Third Bank of the United States” (there were two other central banks that were canceled by presidents in our history) or “The Central Bank of The United States” or "The People's Bank of America." They intentionally mislabeled it “Federal,” to make it sound like a government organization or department, which it is not. They put “Reserve” in the name even though it doesn’t have any reserves; all of its gold was “confiscated” by the U.S. Treasury in 1934 with the Gold Reserve Act of 1934.

The Federal Reserve is actually owned and run by a cabal of about 24 banks and “primary dealers,” who sell government securities like treasury bills and bonds, such as Goldman-Sachs, Citibank, JPMorgan Chase, Bank of America, etc. As its name suggests, it has a primary mission to obscure its functions and deals. It uses jargon and misdirection plays like a high school football coach. The Fed always insists it is independent and transparent, but it has never allowed a full, “forensic” audit of its holdings and deals. It could be argued that Jerome Powell, the current Fed chairman, is more powerful than the president of the United States.

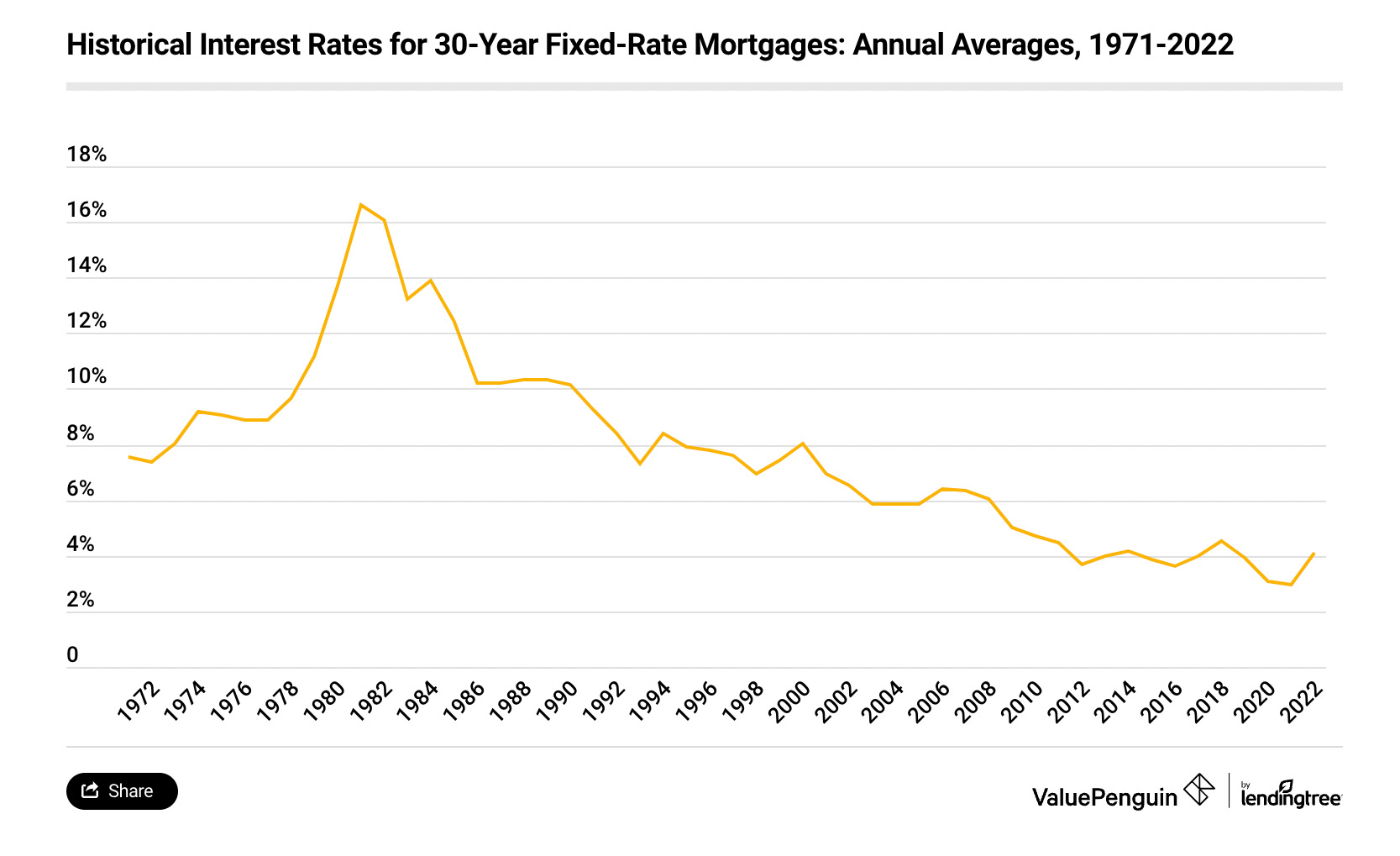

The master or “maestro” (because he played the saxophone in college) of obfuscation was Alan Greenspan, the Fed chair before Ben Bernanke, who once said, “If you understand me, then I’m not doing my job" (or words to that effect). Ironically, Ronald Reagan appointed Greenspan to head the Federal Reserve in 1987 because Greenspan was an acolyte of Ayn Rand and was a "gold bug," who believed that we needed to go back to a gold standard. (See Greenspan's essay in Ayn Rand's book, Capitalism–The Unknown Ideal. Click on the image of this book above to order a copy on AbeBooks.com.) After he was appointed, he started the famous “Greenspan Put,” which put a floor under the stock market, so congresspeople and investors would never suffer any losses on their stock market investments. Greenspan started the process of printing huge amounts of currency to bail out Wall Street and the government. He was directly responsible for the Dot-com Boom and Bust of 2000 and the Housing Bubble and Bust of 2001-2008.

Here's a history of the currency and how it's changed over the decades:

The Federal Reserve is unconstitutional (only the US Treasury can issue currency, and it can only be gold warehouse receipts or gold-backed currency redeemable in gold, according to the U.S. Constitution), but the Federal Reserve helps the banks and politicians gain more control over the economy and us, because they can print more currency and fund all sorts of government programs.

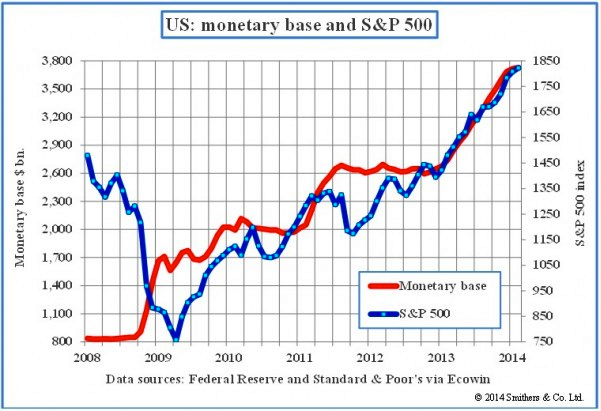

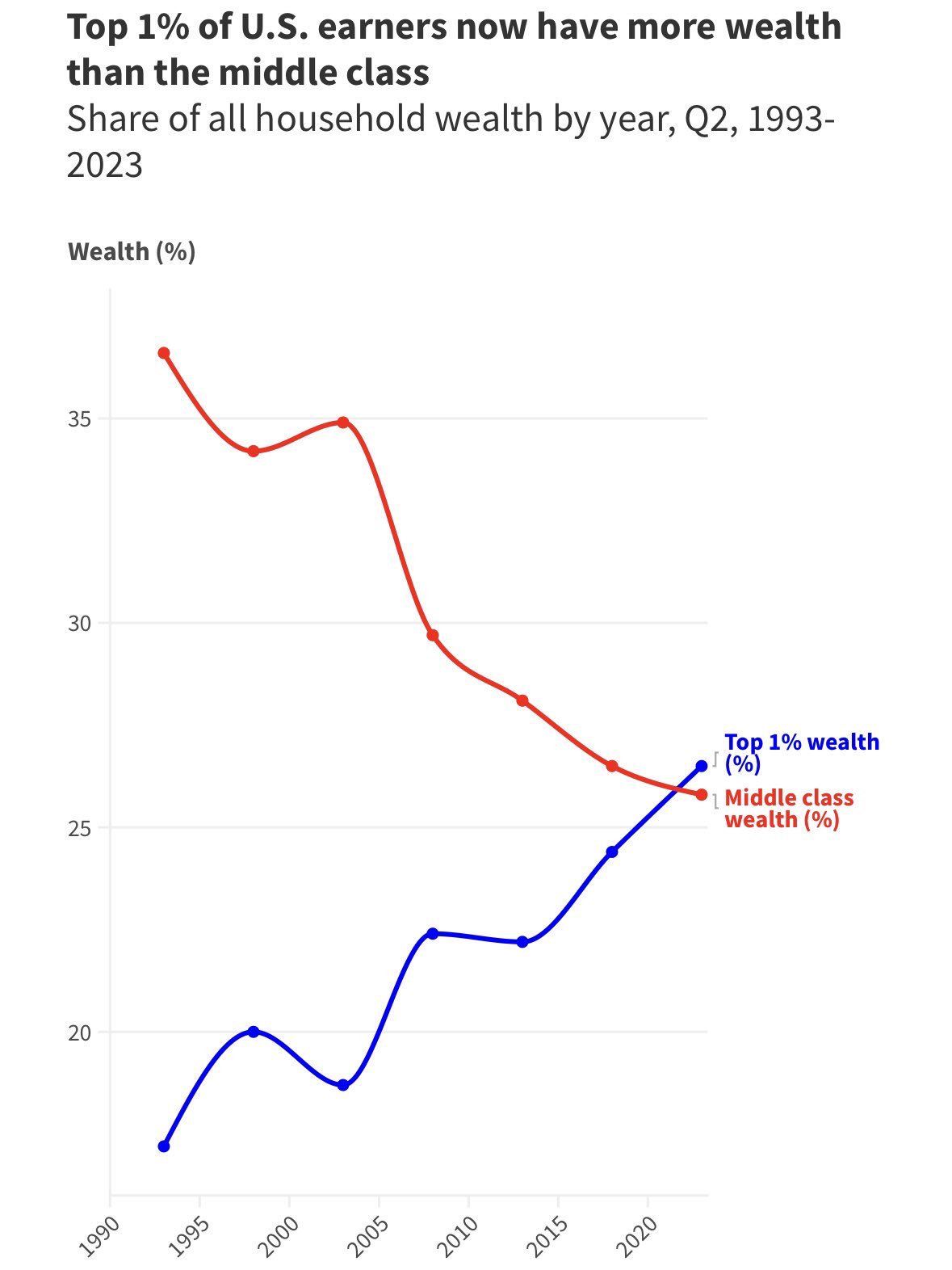

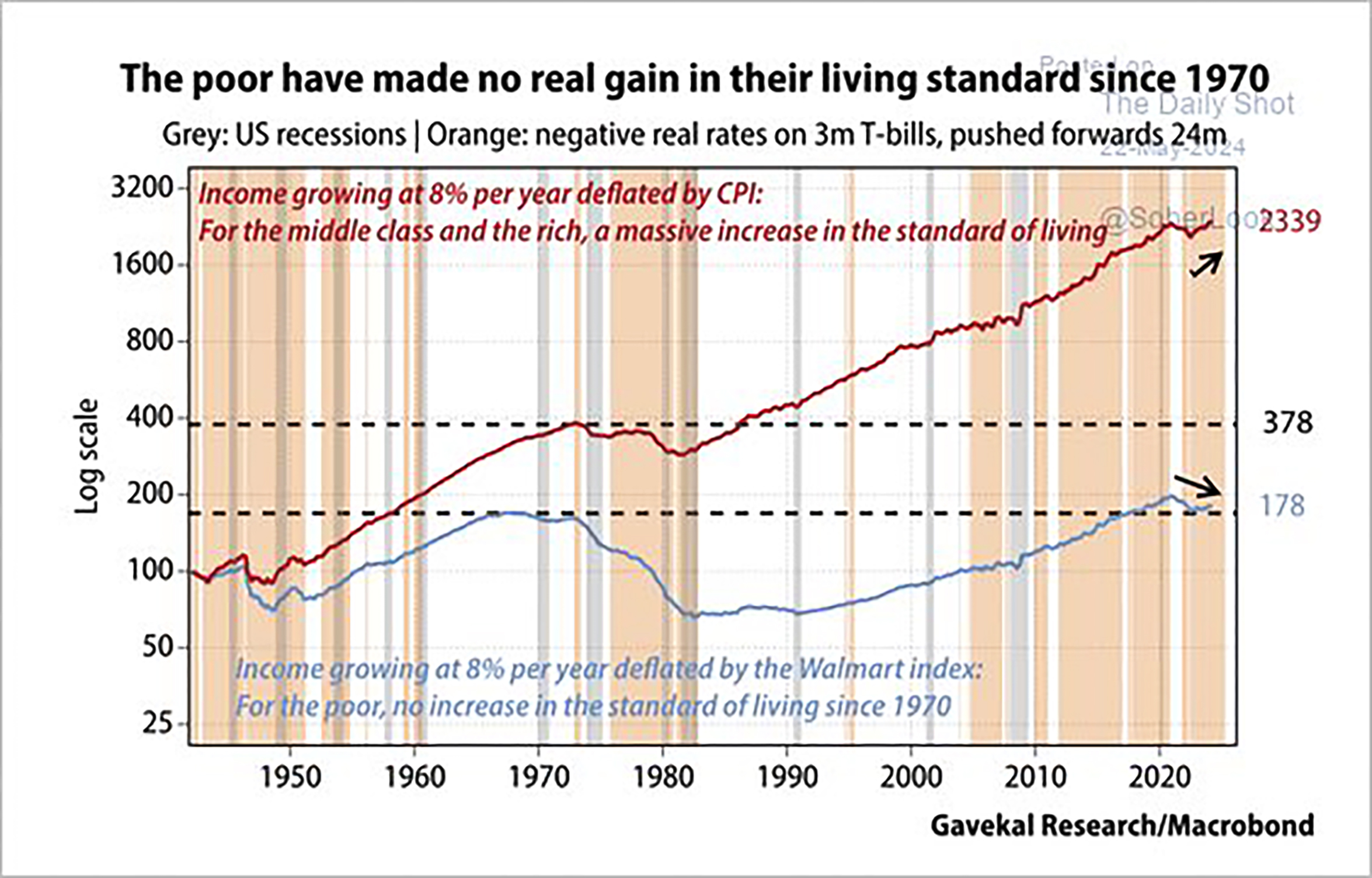

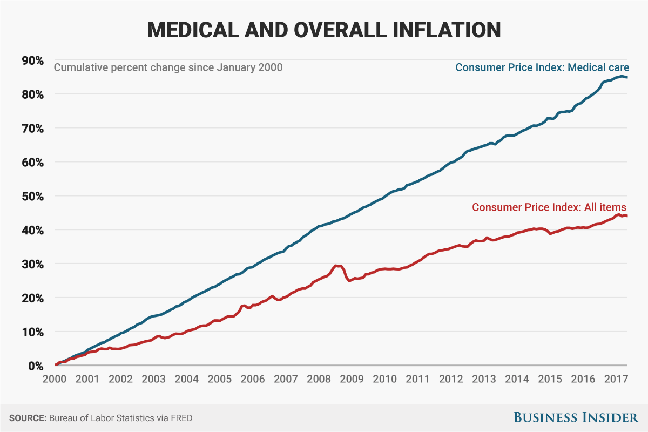

The massive currency-printing by the Fed results in huge distortions and mal-investments in the economy. It results in thousands of zombie companies that can only exist with very low cost funding. It also causes a staggering increase in income inequality as the economy becomes more and more financialized which benefits only the upper 1% of the population who own assets like real estate, stock and bonds, gold and silver, etc.

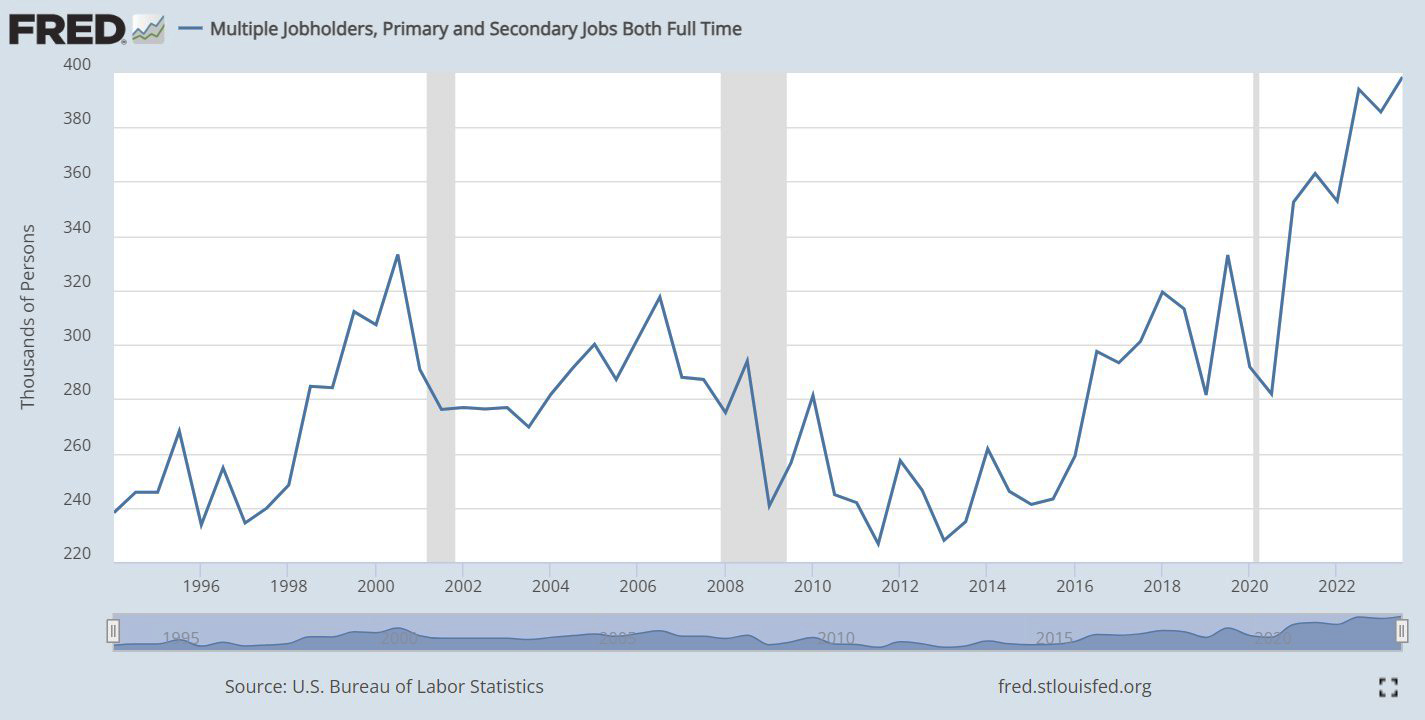

Multiple Jobholders in the U.S. (Workers with two full-time jobs!)

Video: New York City in the 1890's

Banking Crisis Articles & Videos

Video: James Rickards Interview on Paradigm – Excellent analysis of the Silicon Valley Bank blowup and the Federal Reserve

Video: Will The Fed Pivot to Avoid Another Financial Crisis – Peter Schiff's Podcast (Episode 877) – Peter explains how the entire banking system could be about to implode. Silicon Valley Bank is the tip of the iceberg.

Article: Silicon Valley Bank Death Watch! | More articles about Silicon Valley Bank | "SVB collapse: Bank fallout shines spotlight on $620 billion hole in banking sector"

🔴 Article: Florida To Make Gold & Silver Official Means Of Payment

🔴 Article: David Stockman: On The Continual Rise In The Cost Of Living... And Why The Fed Has No Shame

🔴 Article: Is The World Lurching Back Toward A Gold Standard?

Video: Banking Failures and Market Crash Will Lead to Reset, CBDCs, and Bitcoin as a Freedom Tool – Ed Dowd Interviewed by Natalie Brunell

Video: Central Bank Digital Currency (CBDC) is Coming – Ed Dowd Interviewed by Jimmy Connor of Bloor Street Capital

Video: Peter Schiff: The Fed Has No Idea How to Fight Inflation, It's Going to Get Much Worse

Article: Zerohedge: Macleod – Gold is Replacing the Dollar

Article: Zerohedge: The BRICS Currency Project Picks Up Speed

Article: Zerohedge: 40+ Nations Returning to Gold Standard

Article: Zerohedge: Money Supply Slump Spells Private Sector Recession

Article: Sound Money Legislation Rapidly Gaining Traction in Many U.S. States

Article: Japan Bankruptcy – The Domino That Takes It All Down?

Article: Here's How "Prosperity" Ends: Global Bubbles Are Popping

Article: Zerohedge: The Fed is Purely a Political Institution and It's Definitely Not a Bank

Video: Alaska Prepper: "This Event Will Change Everything" – Why CBDCs (Central Bank Digital Currencies) are so dangerous

Article: Zerohedge: Rate Hikes Beatings Will Continue Until Morale Declines – How the Federal Reserve is Killing the Economy

Video: Lost Decade: Predicting The Downfall Of America – Terrifying Financial Crisis Ahead – Jim Rickards

Video: Europe is facing ECONOMIC HELL, and America is close behind. Watch Europe collapse in the next 4 months, then… – Glenn Beck Show

Article: The U.S. Government is Bankrupt

Video: Egon von Greyerz Interview – "The Era of Fake Money is Gone" – Greg Hunter's USAWatchdog.com

Video: Mike Maloney: "Hidden Secrets of Money, Episode 1: Currency vs. Money" See more of Mike Maloney's episodes on YouTube

Video: Jim Rickards Explains Why America is Entering a Horrific Financial Crisis

Video: Financial System - Lawless Criminal Control Syndicate – Catherine Austin Fitts

Article: Zerohedge: The Collapsing Euro and Its Implications

Article: Zerohedge: Contra Ben Bernanke, The Gold Standard Promotes Economic Stability

Article: Is There a Case for the Pre-1914 Gold Standard? Yes, If You Believe Inflation Is a Bad Thing

Article: Central Bankers' Narratives Are Falling Apart

Article: How the U.S. Conquered Inflation Following the Civil War

Article: Is the Global Debt Bubble About to Burst?

Article: The Failure of Central Banks – Politics

Article: 20 Things You Will Need To Survive When the Economy Collapses

Article: In Gold We Trust Report (PDF file) ![]()

Video: Jim Rickards ‘Aftermath’: the coming financial crisis and return to gold

Audio: QTR #293 – Andy Schectman: Stocks, Bonds, and Real Estate Willl All Get Vaporized

Video: "The Fed Will Seize All Your Money In This Crisis" — Peter Schiff's Last WARNING

🔴 = Newest videos and articlesDEFINITIONS (adapted from the Merriam-Webster's Online Dictionary):

Inflation: an increase in the volume of currency and credit relative to available goods and services.

Price Inflation: a continuing rise in the general price level usually attributed to inflation.

Deflation: a contraction in the volume of available currency and credit that results in a general decline in prices.

Disinflation: a reduction in the inflation rate (not the same as deflation).

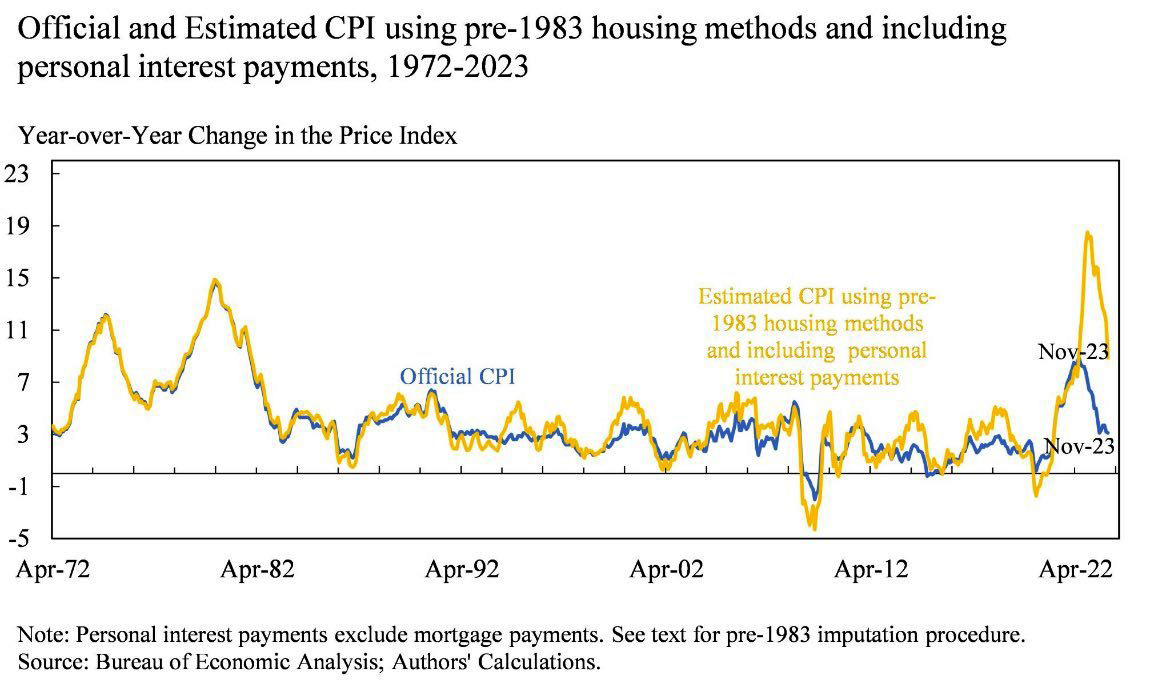

See the real rate of inflation at ShadowStats – the gray bars at the far right of the chart above represent the real rate of inflation.

Why stimulus checks are so bad for the economy

Wow, free money. Who doesn’t want that? What could possibly go wrong?

The circus comes to town. A restaurant sees a huge increase in business, not realizing that it’s only temporary, because the circus is only staying in that town for a couple of weeks. The restaurant owner decides to expand his restaurant and hire more workers. He adds another dining section to his existing structure at great expense. He orders more furniture, utensils, food, etc. He hires three more waitpersons and a new sous-chef. Business is good for a few weeks, even after the circus folds up its tent and moves on to the next venue. Then, suddenly, business goes way down. The restauranteur is forced to lay off the three waitpersons and the sous-chef. He has to give up the extra space to a sub-leaser, who opens a real estate office (whose business is also going to decrease soon). When the government issues stimulus checks, the same process occurs. Restaurants, malls, shops, online stores, etc. all see an increase in business, that soon dries up. (Where are the new stimulus checks?) They all overexpand, then have to cut back, and many will go out of business.

(With thanks to Peter Schiff.)